Passwords 101: What Every Member Should Know

In the digital age, passwords are the first line of defense between your private data and cybercriminals. Yet, many people still underestimate the importance of strong, secure passwords and changing them periodically. From digital banking to mobile apps, checking your email to signing into Netflix, protecting your passwords is essential to keeping your information and money safe.

Let’s walk through why password protection matters – and how you can keep your accounts safe from cyber threats.

Why Password Protection Matters

Think of your password like the key to your house. If it’s flimsy or easy to duplicate, you’re inviting trouble. Weak passwords are one of the most common entry points for cyberattacks, and they use them to gain access to:

- Your personal information

- Your online banking to transfer funds

- Commit identity theft

One compromised password can lead to unfortunate financial consequences.

The Don’ts of Password Protection

Avoid these common mistakes:

- Don’t use personal info like your name, birthday, or pet’s name.

- Don’t reuse passwords across multiple accounts.

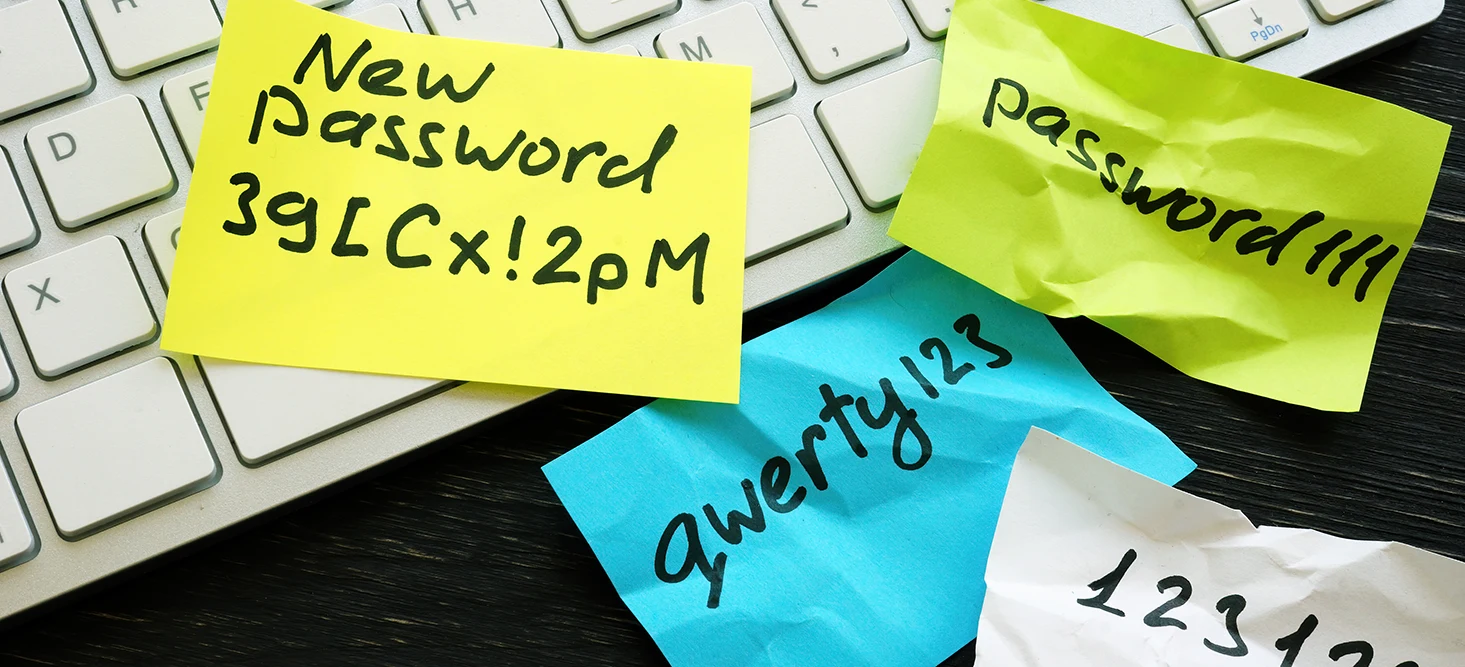

- Don’t use common passwords like “123456”, “xyz123” or “P@ssw0rd123”

- Don’t write passwords on sticky notes.

The Do’s of Creating a Strong Password

Strong passwords are:

- Long – at least 12-16 characters.

- Complex – Includes uppercase, lowercase, numbers, and special symbols.

- Random – Avoid real words or predictable patterns.

- Unique – Never use the same password twice.

Example of a strong password: Gz!3m#Pq8v@7Pt

Did you think “I can’t remember that”? We understand the struggle, especially if you have a lot of accounts. Don’t worry – that’s where a secure password manager comes in handy!

Password Manager

Trying to remember more then 1-2 long and complex passwords can be difficult and frustrating and we’ve felt the same way, so you’re not alone. A password manager helps:

- Store your passwords in a secure place

- Generates complex passwords for you

- Fills those passwords into the sites automatically when you need them

- You only need to remember the one strong password (for the password manager)!

Examples of password manager products available are*:

- LastPass

- 1Password

- Bitwarden

- Dashlane

- Keeper

- NordPass

Add Another Defense Layer: Two-Factor Authentication (2FA)

We strongly recommend enabling Two-Factor Authentication (2FA) when available. This adds a second verification step to prove it’s really you. 2FA can be a code sent to your phone or email, an app-based code (like Google Authenticator) or a physical security token.

Adding 2FA is your security system in your home. Even if your password (house key) gets stolen, the 2FA will kick in to help prevent unwanted intruders.

Password Safety Checklist:

- Change passwords regularly

- Use a password manager

- Turn on 2FA (when possible)

- Log out of devices after use – especially shared or public ones

- Never share your passwords with anyone

As your trusted credit union, we’re here to help protect your financial future – but security starts with you.

Strong passwords and smart habits go a long way in protecting you and your accounts. If you believe your account has been compromised, contact us immediately. Together, we can Stand Tall against fraudsters.

Questions? Call/text 503.588.0211 or email creditunion@ourgrovecu.com.

Read more fraud prevention posts:

- Fraud Unmasked: How to Recognize and Avoid Common Scams

- QR Codes: Smart Tips & What to Watch Out For

- The Subtle Clues You’re Being Scammed (and How to Stop It)

Related Posts

Heritage Grove does not recommend or have any affiliation with any password manager program. Researching these products is the responsibility of any individual using them and Heritage Grove is not responsible for any aspect of that relationship.